Thursday 25 February 2021

Growth of the food & beverages industry is expected to drive the market for self-adhesive labels

The global self-adhesive labels market size is projected to grow from USD 46.5 billion in 2020 to USD 59.2 billion by 2025, at a CAGR of 4.9%. The demand for self-adhesive labels can be attributed to the increasing disposable incomes of people in developing countries and changing preferences of manufacturers for cost-efficient and effective labeling, which compel people to rely on modern labeling techniques. Lack of awareness about various types of labeling techniques factors in decreasing the demand for labels. Varying environmental mandates in terms of printing on labels across different regions and the increasing cost of raw materials are significant challenges faced by manufacturers.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=96664367

A large number of self-adhesive labels are used in the food industry for fresh food, meat, fish, seafood, fresh produce, poultry, and ready meals. Increase in demand for convenience and quality food products has led the market for self-adhesive labels.

Recent Developments

In March 2020, CCL Industries Inc. acquired Flexpol sp. z.o.o. (Flexpol), which currently trades as Innovia Poland. This acquisition is expected to enhance the existing capabilities of the company to serve the label industry in the European region.

In March 2020, Coveris acquired Plasztik-Tranzit Kft (Hungary), a producer of flexible packaging solutions for the food industry. The acquired company is renamed as Coveris Pirto and is a part of Coveria Holdings. This strategic development is expected to create a center for high-tech packaging manufacturing in East Europe and to boost the production capability of the company in the medical, food, and films end-markets.

The APAC region is projected to lead the self-adhesive labels market, in terms of both value and volume from 2020 to 2025. The usage of self-adhesive labels in the region has increased due to cost effectiveness, easy availability of raw materials, and demand for product labeling from highly populated countries such as India and China. The increasing scope of applications of self-adhesive labels in the food & beverage, healthcare, and personal care industries in the region is expected to drive the self-adhesive labels market in APAC. The growing population in these countries presents a huge customer base for FMCG products and food & beverages. Industrialization, growing middle-class population, rising disposable income, changing lifestyles, and rising consumption of packed products are expected to drive the demand for self-adhesive labels during the forecast period.

Inquiry Before Buying: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=96664367

Tuesday 23 February 2021

Convenience and concerns about product safety drives the Plastic Caps and Closures Market

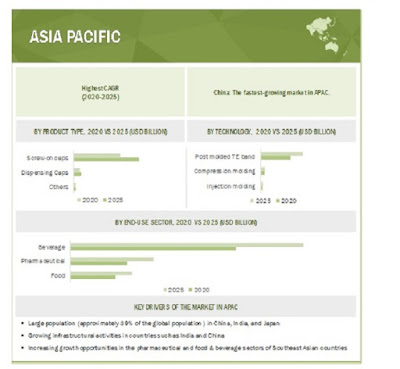

The global plastic caps and closures market size is projected to grow from USD 44.3 billion in 2020 to USD 57.0 billion by 2025, at a CAGR of 5.2% between 2020 and 2025. Factors such as the need for convenience and better operability act as important drivers for plastic caps & closures. A plastic cap plays a key role in safeguarding the product from dust and other microbes. Plastic caps & closures are cost-effective as compared to metal caps & closures. Consumers are on the lookout for closures that are user-friendly, easy to open, and convenient to use.

The rising popularity of dispensing closures and pump closures in various product groups such as body care, skincare, beverages, and liquid food products is likely to spur the growth of the plastic caps & closures market, globally. The health and wellness trend is now shifting toward preventive healthcare, propelling the demand for FMCG products that target improved lifestyles. Plastic caps & closures that prevent contamination, tampering, and counterfeiting are becoming increasingly important to reassure consumers about the safety and authenticity of the products that they are buying.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=132939537

Recent Developments

- In July 2019, Berry Global Group acquired RPC Group for approximately USD 6.5 billion. This acquisition helped create a leading global supplier of value-added protective solutions and one of the world’s largest plastic packaging companies. Also, the company has broadened its global footprint consisting of over 290 locations worldwide, including in North and South America, Europe, Asia, Africa, and Australia.

- In June 2019, Amcor acquired Bemis Company Inc. The combined company will now operate as Amcor Plc (Amcor). The acquisition of Bemis has brought additional scale, capabilities, and footprint that has strengthened Amcor’s industry-leading value proposition and generate significant value for shareholders.

Berry Group (US), Crown Holding (US), AptarGroup (US), Amcor (Australia), BERICAP (Germany), Coral Products (UK), Silgan Holdings (US), O.Berk Company, LLC (US), Guala Closures (Italy), United Caps (Luxembourg), Caps & Closures Pty Ltd. (Australia), Caprite Australia Pty Ltd. (Australia), Pano Cap (Canada) Limited (Canada), Plastic Closures Ltd. (UK), Cap & Seal Pvt. Ltd. (India), Phoenix Closures (US), Alupac India (India), Hicap Closures (China), MJS Packaging (US), J.L. Clark (US), TriMas (US), and Comar, LLC (US) are some of the players operating in the global plastic caps & closures market.

Thursday 18 February 2021

Fresh Food Packaging Market- Innovations in eco-friendly packaging

Governments across the world are focusing on reducing environmental pollution and encouraging end-use sectors to opt for eco-friendly solutions. There are stringent regulations for plastic landfills in Europe. The European Union intends to achieve ‘zero plastics to landfill’ by 2025. In view of the growing concerns related to environmental pollution, packaging companies are focusing on eco-friendly solutions for environmental sustainability. Green packaging products are designed to adhere to the three ‘R’s of eco-friendly packaging: renew, reuse, and recycle. The governments of the developing countries are encouraging packaging solution providers to provide eco-friendly products. Eco-friendly packaging products are made of natural bio-polymer, which is more flexible than traditional plastic.

The global fresh food packaging market size is projected to grow from USD 79.8 billion in 2020 to USD 95.2 billion by 2025, at a CAGR of 3.5% between 2020 and 2025. The major driving factors of the market include growing demand for convenience food items and innovative packaging solutions for extended shelf life of fresh food items.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=240678791

Fresh food packaging can be made using eco-friendly packaging materials, such as bioplastics, recycled papers, forest wood, and palm leaf. Recycled packaging materials are used widely by producers to provide eco-friendly packaging materials, including corrugated cartons, glass, steel, and paperboard. One such product is the molded pulp tray; the product is made of recycled material and is eco-friendly.

Meat products to be a promising application of the fresh food packaging market

Packaging protects meat products during processing, storage, and distribution. The aim of any packaging system for fresh muscle foods is to prevent or delay undesirable changes in appearance, flavor, odor, and texture. Consumers’ rejection of the product is possible if the mentioned quality is not met. Thus, a new technical tool is introduced in the market called ‘Active and Intelligent packaging,’ which better controls the food from contamination and maintains its quality. In meat products, converted roll stock is the largest pack type as it can take any shape and size.

The APAC region leads the fresh food packaging market in terms of volume.

APAC is projected to be the fastest-growing market for fresh food packaging during the forecast period. Increase in demand for convenience by consumers and concerns about food product safety are some of the major reasons that could drive the fresh food packaging market in the region. However, the fresh food packaging market faces restraints such as stringent government rules and regulations regarding raw materials, which hinder the growth of the market.

Major players operating in the global fresh food packaging market includeAmcor PLC (Australia), Interntional Paper Company (US), WestRock Company (US), Sealed Air Corporation (US), Smurfit Kappa (Ireland), Coveris (Vienna), DuPont (US), DS Smith PLC (UK), Mondi PLC (South Africa), Sonoco Products Co. (US), Anchor Packaging Inc. (US), Printpack Inc. (US), Bomarko Inc. (US), and Packaging Corporation of America (US).

Read More: https://www.marketsandmarkets.com/ResearchInsight/fresh-food-packaging-market.asp

The global fresh food packaging market size is projected to grow from USD 79.8 billion in 2020 to USD 95.2 billion by 2025, at a CAGR of 3.5% between 2020 and 2025. The major driving factors of the market include growing demand for convenience food items and innovative packaging solutions for extended shelf life of fresh food items.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=240678791

Fresh food packaging can be made using eco-friendly packaging materials, such as bioplastics, recycled papers, forest wood, and palm leaf. Recycled packaging materials are used widely by producers to provide eco-friendly packaging materials, including corrugated cartons, glass, steel, and paperboard. One such product is the molded pulp tray; the product is made of recycled material and is eco-friendly.

Meat products to be a promising application of the fresh food packaging market

Packaging protects meat products during processing, storage, and distribution. The aim of any packaging system for fresh muscle foods is to prevent or delay undesirable changes in appearance, flavor, odor, and texture. Consumers’ rejection of the product is possible if the mentioned quality is not met. Thus, a new technical tool is introduced in the market called ‘Active and Intelligent packaging,’ which better controls the food from contamination and maintains its quality. In meat products, converted roll stock is the largest pack type as it can take any shape and size.

The APAC region leads the fresh food packaging market in terms of volume.

APAC is projected to be the fastest-growing market for fresh food packaging during the forecast period. Increase in demand for convenience by consumers and concerns about food product safety are some of the major reasons that could drive the fresh food packaging market in the region. However, the fresh food packaging market faces restraints such as stringent government rules and regulations regarding raw materials, which hinder the growth of the market.

Major players operating in the global fresh food packaging market includeAmcor PLC (Australia), Interntional Paper Company (US), WestRock Company (US), Sealed Air Corporation (US), Smurfit Kappa (Ireland), Coveris (Vienna), DuPont (US), DS Smith PLC (UK), Mondi PLC (South Africa), Sonoco Products Co. (US), Anchor Packaging Inc. (US), Printpack Inc. (US), Bomarko Inc. (US), and Packaging Corporation of America (US).

Read More: https://www.marketsandmarkets.com/ResearchInsight/fresh-food-packaging-market.asp

Subscribe to:

Posts (Atom)

DS Smith (UK), Smurfit Kappa (Ireland) and CCL Industries Inc. (Canada) are leading players in Digital Printing Packaging Market

The global digital printing packaging market size is projected to grow from USD 29.4 billion in 2022 to USD 45.1 billion by 2027, at a CAGR...

-

Crown Holding (US) and Amcor (Australia) are the Key Players in the Plastic Caps and Closures MarketMarketsandMarkets projects that the plastic caps and closures market size will grow from USD 40.52 Billion in 2018 to USD 51.67 Billion ...

-

The report “ Inventory Tags Market by Technology (Barcodes, RFID), Label Type (Plastic, Paper, Metal), Printing technology (Digital ...

-

The global self-adhesive labels market size is projected to grow from USD 47.9 billion in 2021 to USD 62.3 billion by 2026, at a CAGR of 5...