Packaging Industry Material news

Monday 11 July 2022

DS Smith (UK), Smurfit Kappa (Ireland) and CCL Industries Inc. (Canada) are leading players in Digital Printing Packaging Market

The global digital printing packaging market size is projected to grow from USD 29.4 billion in 2022 to USD 45.1 billion by 2027, at a CAGR of 8.9% from 2022 to 2027. The growth of the digital printing packaging market is because of its ability to offer aesthetic appeal to packed products as most purchasing decisions are made at the point of sale. The usage of digital printing in packaging is growing, and the need to reduce the cost of printing without compromising the quality of the image will drive the market for digital printing. In 2020, the digital printing packaging market had a nominal impact on its demand due to COVID-19. Slowing raw material production, supply chain disruption, hampered trade movements, declining construction demand, and reduced demand for new projects also have hampered market growth.

The digital printing packaging market has major players including DS Smith (UK), Smurfit Kappa (Ireland), CCL Industries Inc. (Canada), Quad/Graphics Inc. (US), and Printpack (US)., among others. These players have adopted various growth strategies, such as mergers & acquisitions to increase their market shares and enhance their product portfolios.

To know about the assumptions considered for the study download the pdf brochure

DS Smith is a global leader in customer-specific packaging with an emphasis on cutting-edge packaging design and local service close to customer facilities. DS Smith meets every market requirement with a product portfolio that includes transit packaging, consumer packaging, displays and promotional packaging, customized protective packaging, and industrial packaging. The company offers packaging solutions, paper products, and recycling services for industries such as food & drink, consumer goods, industrial, e-commerce & e-retail, and converters. DS Smith operates in over 30 countries. It offers packaging solutions in North America, Europe, and Asia Pacific. The company follows a circular business model.

Smurfit Kappa is Europe’s leading manufacturer of corrugated packaging, containerboard, and bag in box. It is the only pan-South American manufacturer of corrugated and containerboard packaging. The company operates in 36 countries, has 242 packaging conversion plants, 34 paper mills, 46 recycling plants and wood procurement, and 34 other production facilities. It provides packaging of 11.7 billion m2 per year. Smurfit Kappa has 350 production sites worldwide, with locations in 23 European countries and 13 American countries. Smurfit Kappa is a member of the FTSE 100.

CCL Industries is the worlds largest label company and a global specialty packaging pioneer. The company has 204 manufacturing facilities across 43 countries on six continents. CCL is the worlds largest converter of pressure-sensitive and specialty extruded film materials for decorative, instructional, functional, and security applications for government institutions and large global customers in the consumer packaging, healthcare and chemicals, consumer electronic devices, and automotive markets. Extruded and laminated plastic tubes, aluminum aerosols and specialty bottles, folded instructional leaflets, precision decorated and die cut components, electronic displays, polymer bank note substrates, and other complementary products and services are sold concurrently to specific end-use markets.

Read More: https://www.marketsandmarkets.com/PressReleases/digital-printing-packaging.asp

Wednesday 15 June 2022

Key Players in the Technical Textile Market

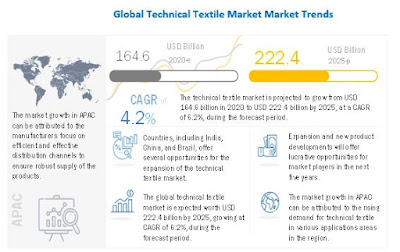

The global technical textile market size is projected to grow from USD 164.6 billion in 2020 to USD 222.4 billion by 2025, at a Compound Annual Growth Rate (CAGR) of 6.2% during the forecast year. The global technical textile market is expanding and is projected to witness high growth over the next five years. Some of the major factors that drive the growth of this market are growing demand for new applications areas and increasing adaptability and awareness of products. The growing awareness about the superior functionality and application of technical textiles encourages the higher consumption of technical textiles and related products.

The technical textile market is led by major players such as Asahi Kasei (Japan), Kimberly Clarke (US), Berry Global Group (US), DuPont (US), Mitsui Chemicals (Japan), and Freudenberg & Co. (Germany). Other players include Low & Bonar (UK), Huntsman (US), Toyobo Co. (Japan), Milliken & Company (US), SRF Limited (India), Koninklijke Ten Cate (Netherlands), and International Textile Group (US). These players have adopted numerous growth strategies to increase their market share, enhance their product portfolio, and expand their market share. Mergers & acquisitions, new product launches, expansions & investments, and agreements & partnerships are some of the major strategies adopted by leading players operating in the technical textile market. The years 2013 and 2020 experienced a large number of investments & expansions by top players in the market.

To know about the assumptions considered for the study download the pdf brochure

Investments & expansions accounted for the largest share of all strategic developments in the technical textile market. Companies such as Berry Global Group, Asahi Kasei, and Freudenberg & Co. adopted this strategy to strengthen their product portfolios, expand their geographic reach, and enhance growth prospects in the technical textile market.

Asahi Kasei (Japan) is a leading manufacturer of apparel material & products, technical textiles & nonwovens, plastic materials, chemicals, and construction materials. Strong global presence and adoption of growth strategies such as investments & expansions and new product launches have ensured its leading position in the market. The company’s technical textiles business deals with a wide range of materials and related products such as cotton, yarns, textiles, and processed products. The group focuses on new product development through research & development activities and innovations. In 2017, Asahi Kasei Fibers & Textiles expanded its capacity to produce Lamous, a high-quality microfiber suede. It is used in a wide variety of applications such as furniture upholstery, automotive interiors, IT accessories, apparel, and industrial materials.

Low & Bonar (UK) is another key player in the technical textile market. The company is engaged in the production of nonwovens for the hygiene, healthcare, geo-synthetics wipes, technical specialties, and building sectors. The company focuses on improving its customer value and expanding in emerging markets by establishing a market-driven product portfolio, upgrading supply chain capabilities, and expanding its presence through acquisitions. For instance, Low & Bonar started its high-performance technical textiles production in Changzhou, to expand its position in the Asian market and become a global leader in the carpet tile backing and automotive markets.

Major market players have adopted diversified strategies for expansion in developed and emerging countries. The Asia Pacific region dominated the technical textile market in 2019. The increase in demand for technical textile can be largely attributed to the growing automobile, medical & healthcare, and construction industries here.

Request for Sample Report: https://www.marketsandmarkets.com/requestsampleNew.asp?id=1074

Tuesday 14 June 2022

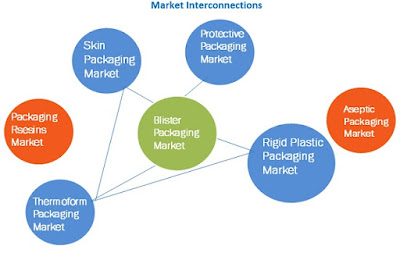

Blister Packaging Market Driver- Cost-effectiveness

The global blister packaging market size is estimated at USD 24.1 billion in 2020 and is projected to reach USD 34.1 billion by 2025, at a CAGR of 7.2%, between 2020 and 2025. Blister packaging is a transparent, portable packaging material, with a flat base and raised cover of plastic, which is tamper-evident and resistant to moisture, protecting the product from damage. The product to be packed is attached to the base substrate, which could be paperboard, rigid plastic, or aluminum foil. A molded, transparent plastic film is sealed to the base substrate through the heat-sealing process. The transparent plastic film offers high visibility of the product.

To know about the assumptions considered for the study download the pdf brochure

There has been a gradual shift in consumer choice from traditional bottles for pharmaceutical products to blister packaging, which is unit-dose packaging. Blister packs are used in the healthcare industry for drugs and medical devices. They are also used in wide applications in consumer goods, industrial goods, and food industries. Moreover, blister packaging requires fewer resources for packaging, occupy less retail shelf space, and offer an excellent hang-hook display. Hence, blister packs are available at a lower cost as compared to other packaging formats, such as rigid bottles, making them cost-effective.

Emerging economies offer high growth potential to the Blister Packaging Market

Emerging economies such as BRIC (Brazil, Russia, India, and China) and CIVETS (Colombia, Indonesia, Vietnam, Egypt, Turkey, and South Africa) are poised to account for much of the global growth for blister packaging in the upcoming years. Growth in these countries is mainly driven by the favorable demographics, rising household incomes, and changing lifestyles of consumers, encouraging a rising preference for on-the-go products. These factors induce changes in lifestyle that lead to greater demand for convenience in terms of packaging and use.

APAC is the fastest-growing market for blister packaging market

APAC is expected to register the highest CAGR during the forecasted period, owing to the rapid expansion of end-use sectors such as healthcare, food, and consumer & industrial goods sectors. Factors such as rising disposable income, growing middle-class population, rising consumption of high visibility products, and the growing healthcare industry will support the growth of the blister packaging market over the forecast period.

Amcor Plc (Switzerland), DOW (US), WestRock Company (US), Sonoco Products Company (US), Constantia Flexibles (Austrai), Klockner Pentaplast Group (Germany), E.I. du Pont de Nemours and Company (US), Honeywell International Inc. (US), Tekni-Plex (US), and Display Pack (US) are the key players operating in the blister packaging market.

Read More: https://www.marketsandmarkets.com/ResearchInsight/blister-packaging-market.asp

Tuesday 7 June 2022

COVID-19 impact on the Global Aerosol Cans Market

The global aerosol cans market size is projected to grow from USD 10.2 billion in 2021 to USD 12.2 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 3.7% during the forecast year. Aerosol can is a self-dispensing pressurized packaging form, with a permanently attached continuous or metering valve that dispenses the required product formulation in the form of aerosol sprays, streams, gels, foams, lotions or gases, as the contents are introduced and contained in the cans under high pressure and are released with the help of a valve that forces them out through a small orifice.

To know about the assumptions considered for the study download the pdf brochure

The manufacturing of aerosol cans was stopped because of the sudden lockdown imposed in the countries causing the shutdown of manufacturing facilities along with their operations. Expect for healthcare, majority of the aerosol can products fall under the catehorgy of non-essential products except for healthcare. As an implication to this the companies had to stop the production of aerosol cans. Companies shifted their focus to the production of facemasks, sanitizer bottles, and other essential products to recover the losses incurred due to the worldwide pandemic. As the lockdown restrictions were lifted, companies resumed their manufacturing operations. They introduced and initiated the production of small-sized aerosol cans, compared to the average size of the aerosol cans. This change in the idea arised due to the prevalent uncertainty of the pandemic in the minds of the customers. Customers are willingly investing in the same for immediate and short-time use, thus reducing the average can size. The resson being that most of the aerosol cans packaged products fall under the non-essential category.

Beauty spa, saloon, personal care parlor, and others are posing a reduced demand of personal care products. However, the demand has increased at homes. There has been an increase in the usage of personal care products at homes. This has eventually increased the demand for aerosol cans. A similar consumer behaviors has been encountered in the case of users of household care and automotive products, across the world. The leverage of having spare time is enabling people to involve themselves in taking care of their house along with their vehicles by themselves. The third-party service providers are witnessing a decrease in demands for aerosol can packed products in household care and automotive. However, the above described commutative increase in demand for aerosol cans is considerably low to fill the reduced demand gap which has arised due to the pandemic. Healthcare aerosol can products are included into the essential products category, and hence, their demand has been witnessing an increase, as compared to the other aerosol can products (such as personal care, household, and automotive).

APAC is the fastest-growing market for aerosol cans market.

APAC is projected to be the fastest growing market for aerosol cans during the forecast period and is projected to register the highest CAGR among all the regions. The growth in aerosol cans market in APAC region is attributed to increasing disposable income in the developing economies such as China and India. Key factors such as industrialization, growth of the convenience food industry, rise in manufacturing activities, increase in disposable income, rise in consumption level, and the growth in retail sales have contributed to the growth of the aerosol cans market during the forecast period in the region. Moreover, the spending on packed food and beauty care has increased, which is driving the demand for aerosol cans in the region.

Ball Corporation (US), Trivium Packaging (US), Crown (US), Mauser Packaging Solutions (US), Toyo Seikan Co. Ltd. (Japan), Nampak Ltd. (South Africa) CCL Container (US), Colep (Portugal), CPMC Holdings Ltd. (China), Guangdong Sihai Iron-Printing and Tin-Making Co.,Ltd. (China), and others are the key players operating in the aerosol cans market.

Request for Sample Report: https://www.marketsandmarkets.com/requestsampleNew.asp?id=48885732

Monday 30 May 2022

5 Recent Developments in Self-Adhesive Labels Market

The global self-adhesive labels market size is projected to grow from USD 47.9 billion in 2021 to USD 62.3 billion by 2026, at a CAGR of 5.4% from 2021 to 2026. Self-adhesive labels are made up of facestock, release liner, and adhesive. They have their back surface coated with an adhesive substrate that eliminates the requirement of glue or moistening. Self-adhesive labels is widely used in applications such as food & beverages, pharmaceuticals, consumer durables, home & personal care, retail labels, e-commerce, amongst others.

The self-adhesive labels market has thousands of companies that thrive in their domestic market. A few of the major players are, CCL Industries Inc. (Canada), Avery Dennison Corporation (US), Multi-Color Corporation (US), Coveris Holdings S.A. (Austria), Huhtamaki OYJ (US), and Fuji Seal International (Japan), among others. These players have adopted various growth strategies, such as mergers & acquisitions, and expansions, to increase their market shares and enhance their product portfolios.

To know about the assumptions considered for the study download the pdf brochure

Recent Developments:

- In October 2021, Multi-Color Corporation acquired the Hexagon Label Group in Australia and New Zealand. This acquisition aims at an enhanced footprint and offerings to ANZ customers with comprehensive label solutions in Adelaide, Brisbane, Griffith, Melbourne, Perth, Sydney, Auckland, and Christchurch.

- In April 2021, Lintec acquired all shares of Duramark, a manufacturer and distributor of various adhesive products. The acquisition provides immediate access to production equipment that Mactac requires to increase the production capacity of adhesive papers and films for labels, its main products.

- In July 2020, CCL Industries Inc. acquired InTouch Labels and Packaging Co., Inc. (InTouch), near Boston, Massachusetts. InTouch is a specialized short-run digital label converter and was added to Avery’s direct-to-consumer operations.

- In March 2020, Avery Dennison announced an investment worth 35 million in the coating technology to expand its Fasson Roll North America pressure-sensitive base materials operations in Greenfield, Indiana. This initiative is expected to significantly expand the production capacity of Fasson-brand paper and film label materials in the US.

- In March 2020, Coveris acquired Plasztik-Tranzit Kft (Hungary), a producer of flexible packaging solutions for the food industry. The acquired company is renamed as Coveris Pirto and is a part of Coveria Holdings. This strategic development is expected to create a center for high-tech packaging manufacturing in East Europe and to boost the production capability of the company in the medical, food and films end-markets.

The APAC region is projected to be the fastest-growing region in the self-adhesive labels market in terms of both value and volume from 2021 to 2026. This region is witnessing the highest growth rate due to the rapid economic expansion. The usage of self-adhesive labels in the region has increased due to cost effectiveness, easy availability of raw materials, and demand for product labeling from highly populated countries such as India and China. The increasing scope of applications of self-adhesive labels in the food & beverage, healthcare, and personal care industries in the region is expected to drive the self-adhesive labels market in APAC. The growing population in these countries presents a huge customer base for FMCG products and food & beverages. Industrialization, growing middle-class population, rising disposable income, changing lifestyles, and rising consumption of packed products are expected to drive the demand for self-adhesive labels during the forecast period.

Request for Sample Report: https://www.marketsandmarkets.com/requestsampleNew.asp?id=96664367

Tuesday 22 February 2022

Fresh Food Packaging Market worth $95.2 billion by 2025

The global fresh food packaging market size is projected to grow from USD 79.8 billion in 2020 to USD 95.2 billion by 2025, at a CAGR of 3.5% between 2020 and 2025.

Packaging plays a vital role in keeping the product fresh, damage-proof and acts as an efficient marketing tool. The fresh food packaging market has been growing in tandem with the growth of the food packaging industry. The fresh food packaging market is segmented based on material, pack type, application, and region. The growth of fresh food packaging has been witnessed due to the growth in the meat products and vegetables application.

To know about the assumptions considered for the study download the pdf brochure

In terms of value, the polypropylene segment is projected to account for the largest share of the fresh food packaging, by material, during the forecast period.

Polypropylene (PP) has a clear, glossy film with high strength and puncture resistance. This material is not affected by changes in humidity. It has moderate permeability to gases and odors and a higher barrier to water vapor. These properties enable the use of polypropylene in the production of a wide variety of food & beverage packaging solutions.

Converted roll stock to be the largest pack type of the fresh food packaging.

Converted roll stock is widely used in the form of bags, pouches, and sachets, among others. Converted roll stock is made from raw materials, such as polyesters, adhesives, silicone, tapes, plastics, rubbers, liners, and metals, to create new products. The roll materials vary in size and weight as per the product requirement. Converted roll stock is the most common pack type used in fresh food packaging.

The meat products application is projected to register the highest CAGR during the forecast period.

Meat products are the largest and fastest-growing application in terms of both value and volume. The growing disposable incomes have fueled the demand for convenience food items, which is, in turn, driving the fresh food packaging market. The increasing awareness regarding the nutritional value of meat products and changing eating habits are also boosting the demand for fresh food packaging.

The APAC region leads the fresh food packaging market in terms of volume.

APAC is projected to be the fastest-growing market for fresh food packaging during the forecast period. Increase in demand for convenience by consumers and concerns about food product safety are some of the major reasons that could drive the fresh food packaging market in the region. However, the fresh food packaging market faces restraints such as stringent government rules and regulations regarding raw materials, which hinder the growth of the market.

Major players operating in the global fresh food packaging market includeAmcor PLC (Australia), Interntional Paper Company (US), WestRock Company (US), Sealed Air Corporation (US), Smurfit Kappa (Ireland), Coveris (Vienna), DuPont (US), DS Smith PLC (UK), Mondi PLC (South Africa), Silgan Holdings Inc. (US), Sonoco Products Co. (US), Schur Flexibles (Austria), Anchor Packaging Inc. (US), Printpack Inc. (US), Bomarko Inc. (US), Packaging Corporation of America (US), Graphic Packaging Holding Co. (US), Ampacet Corporation (US), Ultimate Packaging Limited (UK), and Temkin International Inc. (Utah).

To Know More Speak with Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=240678791

Thursday 10 February 2022

5 Top Recent Development in Blister Packaging Market

The blister packaging market size is projected to grow from USD 24.1 billion in 2020 to USD 34.1 billion by 2025, at a CAGR of 7.2%. The blister packaging market is witnessing growing demand from end-use industries such as healthcare, food, consumer goods, and industrial goods. Its growth is attributed to cost-effectiveness and tamper-evident design for product protection.

Inquiry Before Buying: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=152751887

APAC is the fastest-growing market for blister packaging market

APAC is expected to register the highest CAGR during the forecasted period, owing to the rapid expansion of end-use sectors such as healthcare, food, and consumer & industrial goods sectors. Factors such as rising disposable income, growing middle-class population, rising consumption of high visibility products, and the growing healthcare industry will support the growth of the blister packaging market over the forecast period.

Recent Developments

- In January 2021, Sonoco Products Company entered into partnership with Integrated Systems, Inc. (US). This partnership will help the company to enhance its automation activities and increase efficiency in global manufacturing operations.

- In September 2020, Amcor Plc developed first recyclable retort flexible packaging with improved environmental footprint of packaging to 60% (approximately). This will allow recycling of high-performance packaging such as wet pet food, ready-meals, baby foods, and pre-cooked soups.

- In August 2020, Sonoco Products Company acquired Can Packaging (France). This acquisition will add two manufacturing facilities, and a R&D facility to the company’s existing assets and fortify its market position in Europe region.

- In July 2020, Dow launched INNATE TF an extension to INNATE precision packaging family. It is a polyethylene resin for tenter frame biaxial orientation films. These are high performance, recyclable, and consumer convenience films.

- In May 2020, Constantia Flexibles acquired TT print (Russia). This acquisition will add pharmaceutical packaging production plant to the company’s asset and will strengthen its pharma division.

Download PDF Brochure to Know More Assumption: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=24775059

DS Smith (UK), Smurfit Kappa (Ireland) and CCL Industries Inc. (Canada) are leading players in Digital Printing Packaging Market

The global digital printing packaging market size is projected to grow from USD 29.4 billion in 2022 to USD 45.1 billion by 2027, at a CAGR...

-

Crown Holding (US) and Amcor (Australia) are the Key Players in the Plastic Caps and Closures MarketMarketsandMarkets projects that the plastic caps and closures market size will grow from USD 40.52 Billion in 2018 to USD 51.67 Billion ...

-

The report “ Inventory Tags Market by Technology (Barcodes, RFID), Label Type (Plastic, Paper, Metal), Printing technology (Digital ...

-

The global digital printing packaging market size is projected to grow from USD 29.4 billion in 2022 to USD 45.1 billion by 2027, at a CAGR...